Network-native exogenous yield

How to save DeFi from centralisation?

Recently, I've been thinking a lot about the exogenous vs endogenous yield problem in crypto highlighted by Vitalik in this post last year. Especially because our thesis at Reflect are stablecoins backed by fully on-chain collateral, we work at the core of that problem. When engineering neutral yield strategies, you quickly realise that there's only so many DeFi primitives for you to utilise, and at some point you have to start looking for productivity elsewhere.

Endogenous vs exogenous

This problem lies at the very core of DeFi, but also traditional financial systems. Endogenous yield is yield generated from within the financial system itself. Examples of these yields include lending yields, like those at Aave or Kamino, or trading, like funding rate yield from neutralised perpetual futures positions on SOL or ETH. Those yields are usually a byproduct of speculation - e.g. users pay fees to borrow USDC against SOL to buy more SOL for leverage, and USDC liquidity providers receive them as profits.

The problem of endogenous yields is that their growth is strongly capped by the size of underlying markets. The lending yields are only as high as is the traders' appetite for leverage. If speculation declines, there’s less borrowers paying less fees and lending becomes less attractive for liquidity providers, who start deploying their assets out of DeFi.

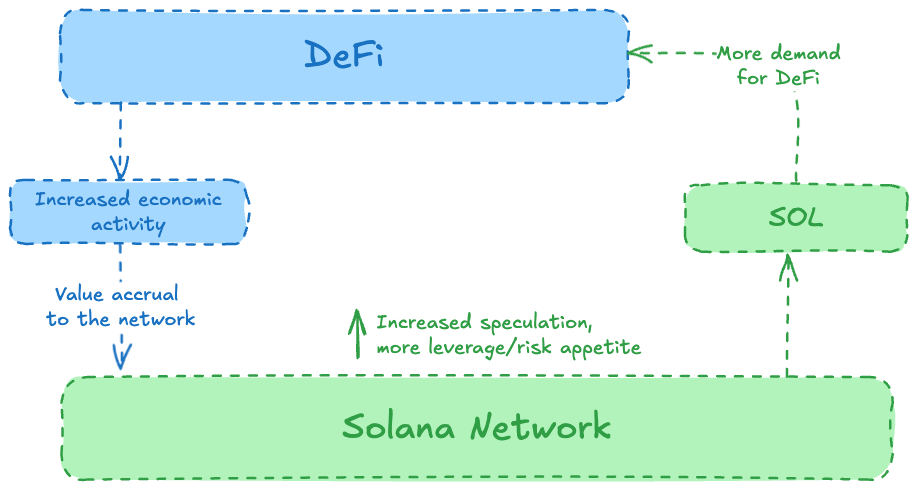

It creates a closed cycle where:

blockchains and their native assets (eg. SOL, ETH) accrue value from economic activity within DeFi,

speculation of crypto assets increases, growing demand for leverage,

increasing economic activity within DeFi.

In short, relying only on endogenous yields makes DeFi only attractive in periods of increased speculation (bull markets). Majority of DeFi struggles during bear markets, and operational costs of those venues often become higher than their revenues, forcing them to close.

Rehypothecation

The above isn't the only problem. Reliance on endogenous yields also increases reliance on derivatives over real assets, and over time, becomes an endless cycle of rehypothecation. Rehypothecation is a process in which collateral once deployed somewhere (or representation of rights to that collateral) is used as collateral for more loans. While some rehypothecation can be healthy, it increases leverage (more exposure from the same amount of collateral) and makes risk management harder.

To show it on a real-world example: Imagine a scenario in which I lend you money for some amount of time, and I'm going to receive some interest from it. In return, I receive a receipt confirming your obligation to repay that loan. I then go to a bank and put that receipt as collateral to borrow more money, so I can lend it for interest to another person, again get a receipt, borrow more money against it, etc.

It increases my profits, because I only borrowed you actual money once, but I get interest from multiple loans. However, it becomes riskier and riskier on every loan. If one person defaults on their loan, I don't have money to return to the bank, so I can’t get back my receipt for another loan. If I don’t claim that receipt, I can’t claim my loan back from the person, so I can’t claim the previous receipt, and so on. One defaulted loan results in cascade of liquidations, because none of the loans can now get repaid.

In traditional finance, this problem has been solved in couple different ways. First, regulation prohibiting endless rehypothecation. This doesn't really work as financial institutions are only required to keep fraction of their reserves liquid, allowing for further deployment of those assets in loans and other instruments. Second, they have a very vibrant ecosystem of exogenous yields running (called the economy), which is something that blockchains struggle with.

Exogenous yield

Exogenous yield is productivity coming from the outside world. Yield that is not generated from the speculation alone, but actual growth of the economy. An example of this might include a loan that company takes to build a new warehouse. They don't take that loan to leverage their exposure to an asset, but to expand their production capabilities and increase their revenues. They then use part of that increased revenue to pay the loan back with interest.

Similarly, government bonds may be an example of exogenous yield. Countries print bonds to borrow money from the society and other governments. They (hopefully) use that money to invest in the economy or provide education so their economies grow increasing their future tax revenue, so they can pay interest back to the holders of the bonds.

Unfortunately, crypto doesn't have those (at least yet), so we mostly rely on endogenous yields from crypto assets. But there’s a solution!

RWA - Bridging TradFi to DeFi

The first, rapidly developing solution to that problem is broader use of traditional financial instruments within DeFi. Assets like bonds, commodities, private credit or institutional structured products are exogenous to DeFi - their yields are not dependent on economic activity within crypto itself, but rather growth of the broader world economy.

Current approach to RWA is fairly simple: take a traditional financial instrument, give it to a licensed custodian, mint token against it and sell it on-chain. Unfortunately, this comes at a massive trade-off.

Majority of the so-called Real World Assets or TradFi products with web3 frontends function like black boxes. You can access them on-chain and deploy liquidity in the form of tokens, but there's no way for you to look into them. They are not native DeFi products allowing you to inspect their reserves, positions and other data on-chain. They only use the blockchain as distribution channel instead of using it as the ledger.

Since those assets inherit security guarantees not from blockchains, but from their centralised custodians, and they carry exactly same risks.

Censorship

Since RWAs are fully managed by centralised custodians, they might be a subject to censorship. Custodians are regulated, usually licensed companies carrying their own legal obligations. Due to legal and political reasons, RWAs might simply not be available in certain countries or certain people. The process of obtaining them on-chain is usually a complex process involving KYC/AML checks performed with centralised infrastructure providers, which adds additional layer of censorship.

Counterparty

All RWAs carry a significant counterparty risk because of their reliance on infrastructure of centralised financial institutions. Wars, banks defaulting or major financial crises might influence security of these assets.

Liquidity

Since actual underlying assets are custodied, tokenised RWAs only act as receipts. They cannot be easily minted or redeemed for the underlying liquidity. Though liquidity may be safe, reliance on centralised parties involving traditional, manual processing of deposits and withdrawals put a constraint on how fast and atomic DeFi powered by RWAs might be. Good example of this is Circle, only allowing USDC redemptions for institutional clients for requests of over $100,000 per redemption.

Even though RWAs bring exogenous yields, they come at an expense of making DeFi slower, less censorship-resistant and more illiquid. They introduce additional counterparty risks as a result of reliance on centralised financial institutions for custody.

Network-level exogenous yield

Instead of relying on custodians and inheriting risks from RWAs, DeFi should seek exogenous yield opportunities that can be built on top of our networks. Approach to simply 'bridging' bonds, stocks and commodities is naive, and trades off the entire DeFi value proposition for simplicity.

To build a broad selection of exogenous yields, in parallel to developing new DeFi primitives, we should develop products that accrue value and generate yield from actual economic activity within the real world. Instead of tokenising traditional financial instruments, we actually need rails to make native financial instruments on top of our networks.

Let's take private credit as an example. Today, most private credit vaults available on-chain are simply stablecoin off-ramps. You deposit USDC, it then gets off-ramped by the vault operators and used for private credit, being transferred between bank accounts within traditional system.

This results in the process being unauditable for liquidity providers. If you deploy stablecoins in such a vault, you won’t have access to information about operations done with your money. You don't see defaults, liquidations, you can't select which companies you want to lend your money to. In fact, you can't be sure whether your money actually gets deployed. The entire product relies on the trust that middlemen (vault operators) are honest actors.

What if we could build alternative private credit venues, transparent and settled on-chain in stablecoins? This removes the middlemen and allows companies to create their own credit markets, with parameters set on market-to-market basis. Information like liquidations or defaults would be recorded onchain. When connected with on-chain treasury powered by fintech built on stablecoin rails (eg. Squads), this would allow individual lenders to inspect their investments and see company's performance for their risk management purposes.

And this doesn’t just apply to private credit - similar products can be built:

for stocks, with legally binding on-chain equity,

for commodities, with spot, options and futures markets,

other financial instruments, traditionally available in web2.

Conclusion

Decentralised finance desperately needs a variety of exogenous yield products to enable growth decoupled from demand for speculation on crypto assets. We can do it by relying on RWAs provided by centralised custodians and trade off our speed, liquidity and censorship resistance, or we can develop decentralised rails for fully on-chain financial instruments accruing value from the real world.

RWAs are developing faster, because centralisation enables simplicity - it’s easy to wrap an asset into a token with a custodian. But we shouldn’t give up on the long-term vision of decentralised finance - variety of transparent, faster and more liquid primitives answering the needs of traditional economies.